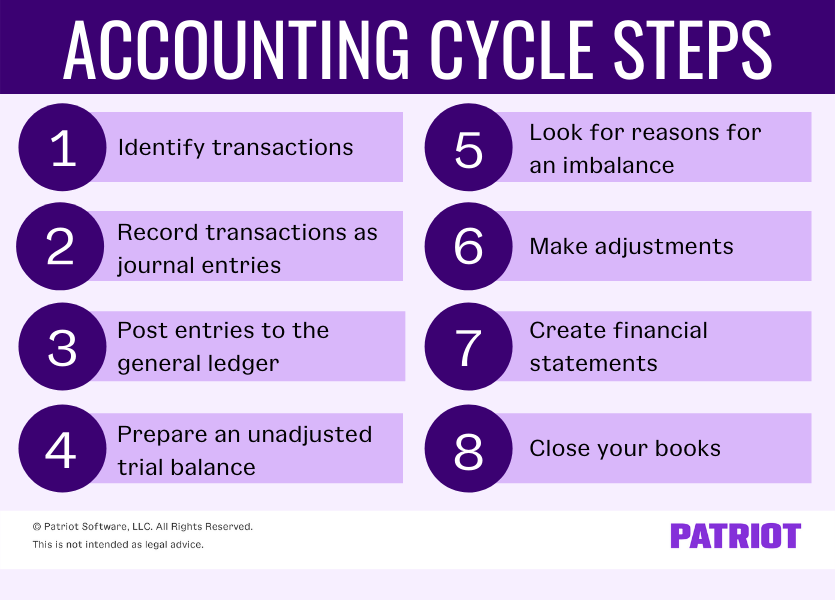

These are used to calculate individual balances for each account. One of the main duties of a bookkeeper is to keep track of the full accounting cycle from start to finish. The cycle repeats itself every fiscal year as long as a company remains in business. After the adjusting entries have been passed and posted to respective ledger accounts, the unadjusted trial balance needs to be corrected to show the impact of these adjustments. For this purpose, an amended trial balance, known as an adjusted trial balance, is prepared. The last step in the accounting cycle is to make closing entries by finalizing expenses, revenues and temporary accounts at the end of the accounting period.

Step 7: Create Financial Statements

Every individual company will usually need to modify the eight-step accounting cycle in certain ways in order to fit with their company’s business model and accounting procedures. Modifications for accrual accounting versus cash accounting are often one major concern. The next step in the accounting cycle is to post the transactions to the general ledger. Think of the general ledger as a summary sheet where all transactions are divided into accounts. It lets you track your business’s finances and understand how much cash you have available.

Step 8: Close the Books

Now, let’s have a closer look on the complete accounting cycle process by performing the following example step by step. Here’s an in-depth look at the eight steps in trial balance worksheet definition. Once you check off all the steps, you can move to the next accounting period. For organizations seeking to optimize their financial closing processes, HighRadius’s Financial Close Management is an indispensable tool. It transforms the accounting cycle by amalgamating automation, anomaly detection, and structured project planning.

Preparing Financial Statements

If it has anything to do with bookkeeping tasks, it’s part of the accounting cycle. From time to time, you may hear it referred to as the bookkeeping cycle. After the company makes all adjusting entries, it then generates its financial statements in the seventh step.

Ensures transaction accuracy and documentation

The accounting cycle is an eight-step process that accountants and business owners use to manage the company’s books throughout a specific accounting period, such as the fiscal year. The federal government’s fiscal year spans 12 months, beginning on October 1 of one calendar year and ending on September 30 of the next. FY 2023 starts on October 1, 2022 and ends on September 30, 2023. The fundamental concepts above will enable you to construct an income statement, balance sheet, and cash flow statement, which are the most important steps in the accounting cycle. To learn more, check out CFI’s free Accounting Fundamentals Course.

- Whether your accounting period is monthly, quarterly, or annually, timing is crucial to implementing the accounting cycle properly.

- To learn more, check out CFI’s free Accounting Fundamentals Course.

- Once you make adjusting journal entries, you run a trial balance one more time.

- Temporary or nominal accounts, i.e. income statement accounts, are closed to prepare the system for the next accounting period.

Interpreting financial statements helps you stay on top of your company’s finances and devise growth strategies. Apart from identifying errors, this step helps match revenue and expenses when accrual accounting is used. Any discrepancies should be addressed by making adjustments, which happens in the next step. Companies can modify the accounting cycle’s steps to fit their business models and accounting procedures.

At the start of the next accounting period, occasionally reversing journal entries are made to cancel out the accrual entries made in the previous period. After the reversing entries are posted, the accounting cycle starts all over again with the occurrence of a new business transaction. The eight-step accounting cycle starts with recording every company transaction individually and ends with a comprehensive report of the company’s activities for the designated cycle timeframe. Many companies use accounting software or other technology to automate the accounting cycle.

At the end of the accounting period, you’ll prepare an unadjusted trial balance. The accounting cycle is a multi-step process designed to convert all of your company’s raw financial information into financial statements. Following the accounting cycle is a standard practice that helps to ensure that all financial transactions are accounted for.

If you use accounting software, posting to the ledger is usually done automatically in the background. Janet-Berry Johnson is a freelance writer, who writes content for BILL. As a licensed CPA, she previously worked in public accounting, specializing in income tax consulting and compliance for individuals and small businesses. Janet graduated Magna Cum Laude from Morrison University with a BS in Accounting. Learn how BILL’s expense management software can help you automate accounts receivables, accounts payables, and payment receipts by signing up today or requesting a demo.